Imagine this: you wake up to find your bank account drained, your social media hijacked. It's not a nightmare; it's the chilling reality of SIM swap fraud, or "Simkaart Truc Kpn", a growing threat in South Africa. This isn't just about losing your phone number; it's about losing control of your entire digital life. This article will equip you with the knowledge and strategies to protect yourself from this sophisticated crime.

Understanding the Simkaart Truc Kpn Threat

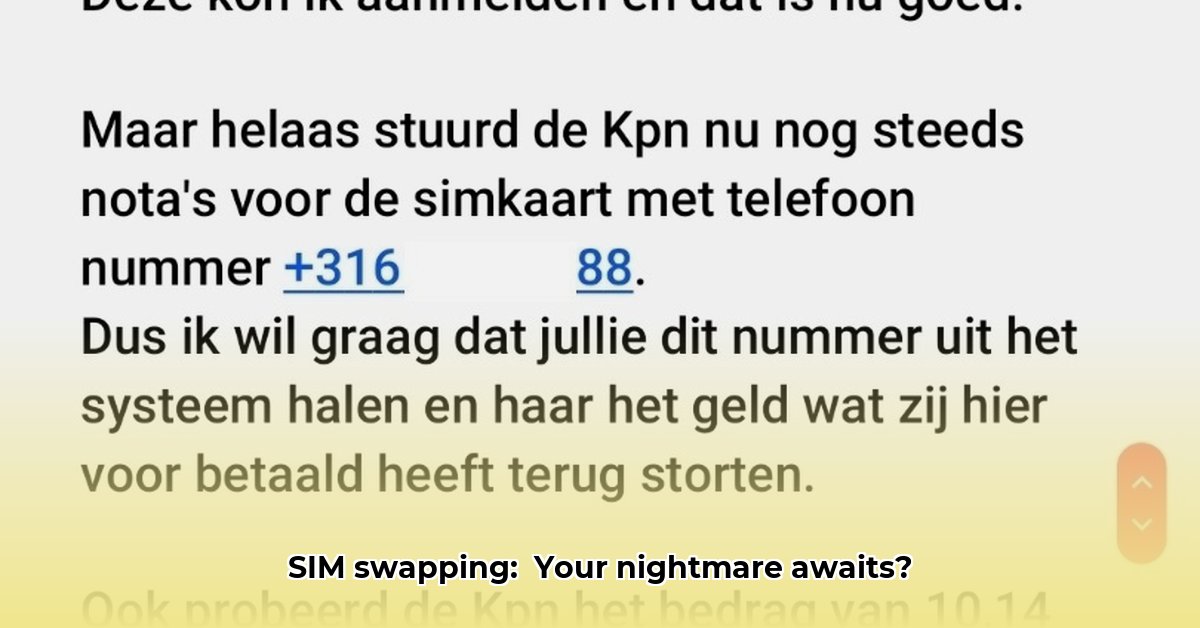

SIM swap fraud is a cunning digital heist. Criminals use various methods—often involving phishing emails or cleverly crafted fake websites—to gather your personal information. Armed with your details, they contact your mobile network provider, convincingly impersonating you to request a SIM card replacement. Once they receive the new SIM, your calls, texts, and crucially, your two-factor authentication (2FA) codes, are redirected to them, granting them access to your online accounts.

What exactly is SIM swap fraud? It's the fraudulent transfer of your mobile phone number to a SIM card controlled by a criminal. This allows them access to your online services linked to that number, such as banking and social media.

Why is it so dangerous? Because most online accounts rely on your phone number for verification, criminals gaining access to it essentially gain access to your entire digital life.

How can you spot it? It often starts with suspicious emails, calls or texts which prompt you to disclose personal information or which contain links to questionable websites.

"These criminals are highly organised," says Prof. Nomusa Mbatha, Cybersecurity Expert at the University of Stellenbosch. "They often employ sophisticated social engineering techniques to trick their victims."

This isn't just a theoretical risk – it's a real-world problem with devastating consequences for victims. The financial losses can be substantial, and the emotional distress significant. However, there are ways to protect yourself.

How the Simkaart Truc Kpn Works: A Step-by-Step Breakdown

The process often unfolds in several stages:

Information Gathering: Criminals employ phishing, social engineering, or data breaches to obtain your personal information. Things like your ID number, address, and even your mother's maiden name can be used to impersonate you.

The Impersonation: Using your gathered information, criminals cleverly impersonate you when contacting your mobile service provider. They claim their SIM card is lost or stolen, requesting a replacement.

The SIM Swap: If successful, the provider will issue a new SIM, activating it with your number and unknowingly handing your digital keys to the criminals.

Account Takeover: Access to your phone number grants access to your 2FA codes, allowing criminals to easily access your online accounts, including banking apps and social media.

"The success rate of SIM swaps is alarmingly high," adds Mr. Thabo Dlamini, Head of Fraud Prevention at First National Bank. “This highlights the need for increased security measures from both service providers and individuals.”

Defending Yourself Against Simkaart Truc Kpn: Practical Steps

The good news is you can significantly reduce your vulnerability. Here’s a multi-layered defence strategy:

Scrutinise Every Communication: Never click links in suspicious emails or SMSs. Verify any unexpected requests directly with the company using contact details you already know, not the ones provided in the questionable communication.

Password Power: Utilise strong, unique passwords for each online account. A password manager can help.

App-Based 2FA is King: Switch from SMS-based 2FA to a more secure app-based system (Google Authenticator, Authy). This adds a critical layer of security, even if criminals obtain your SIM.

Regular Account Checks: Regularly review your bank statements and online accounts for any unauthorised activity.

Report Immediately: If you suspect a SIM swap, report it instantly to your mobile provider and the South African Police Service (SAPS).

Have you considered the financial implications of this digital crime? One victim reported losses exceeding R50,000.

The Role of Mobile Networks and the Government

Mobile network providers have a crucial role to play. Strengthening verification processes for SIM swaps through stricter ID checks or biometric authentication is vital. They also need to enhance their fraud detection systems. The government can contribute by educating the public and strengthening regulations concerning data protection and SIM card management.

What role do you think the government should play in protecting citizens from SIM swap fraud?

A Collaborative Approach to Security

SIM swap fraud is a challenging problem, but not insurmountable. By working together – mobile providers, government, and individuals – we can create a safer digital environment. Staying informed, being vigilant, and adopting these preventative measures are crucial in reducing the risk. Remember, your digital security is your responsibility. Take action today.